2022 tax withholding calculator

Withholding Tax Computation Rules Tables and Methods. WASHINGTON Following the biggest set of tax law changes in more than 30 years the Internal Revenue Service continues to remind taxpayers to do a Paycheck Checkup to help make sure they are having the right amount of tax withheld.

Payroll Tax What It Is How To Calculate It Bench Accounting

It describes how to figure withholding using the Wage Bracket Method or Percentage Method describes the alternative methods for figuring withholding and provides the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members.

. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets. This calculator is for 2022 Tax Returns due in 2023.

If your personal or financial situation changes for 2022 for example your job starts in. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. In 2022 for each qualifying child you can receive up to a 2000 tax credit.

United States Tax Calculator for 202223. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

Oregon personal income tax withholding and calculator Currently selected. Between 2021 and 2022 many of the changes brought about by the Tax Cuts and Jobs Act of 2017 remain the same. The above calculator provides for interest calculation as per Income-tax Act.

The Sales Tax Deduction Calculator IRSgovSalesTax figures the amount you can claim if you itemize deductions on Schedule A Form 1040. Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document. The amount you earn.

Once you have an idea of how much you owe the IRS its time to compare that amount to your total withholding. The amount of income tax your employer withholds from your regular pay depends on two things. Submit or give Form W-4 to your employer.

Calculations are based on rates known as of June 17 2022 including federal and provincialterritorial tax changes known at this time. 202223 Tax Refund Calculator. The Cumulative Average Method in computing withholding taxes where the total supplementary compensation is equal or greater than the total regular compensation cannot be accommodated in the calculator.

The federal income tax withholding tables are included in Pub. No withholding allowances on 2020 and later Forms W-4. In 2021 the tax credit was up to a 3600 per child under age six and up to 3000 per child age six to 17.

Take your annual tax withholding and subtract your estimated tax liability. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022. In that case youd have a potential 1200 deficit.

The following are aspects of federal income tax withholding that are unchanged in 2022. For wages this information usually can be found on your last and most recent paystubs. Lets continue our example from above and assume your estimated tax liability is 9600.

2022 rates will be effective Feb 1 2022. WASHINGTON The Internal Revenue Service today released an updated Withholding Calculator on IRSgov and a new version of Form W-4 to help taxpayers check their 2018 tax withholding following passage of the Tax Cuts and Jobs Act in December. The Arizona tax calculator is updated for the 202223 tax year.

NYS-50-T-NYS 122 New York State withholding tax tables and methods. Formula based on OFFICIAL BIR tax tables. The Arizona income tax calculator is designed to provide a salary example with salary deductions made in Arizona.

2022 Philippines BIR TRAIN Withholding Tax calculator for employees. If you pay state unemployment taxes you are eligible for a tax. The Liberty Tax Service withholding calculator helps determine your potential tax liability.

To estimate the impact of the TRAIN Law on your compensation income click here. The information you give your employer on Form W4. Getting answers to your tax questions.

Deduct the amount of tax paid from the tax calculation to provide an illustration of your 202223 tax refund. IR-2019-110 June 12 2019. Get a recommendation on your tax withholding from Liberty Tax.

Ask your employer if they use an automated system to submit Form W-4. 2021 2022 tax brackets and most tax credits have been verified to Canada Revenue Agency and provincial factors. How to calculate Federal Tax based on your Annual Income.

Indicates that a field is required. Deduct and Match FICA Taxes. The IRS urges taxpayers to use these tools to make sure they have the right.

The Tax Cuts and Jobs Act TCJA tax reform legislation enacted in December 2017 changed the way. Federal income tax ranges from 0 to 37. IR-2018-36 February 28 2018.

The tax tables and methods have been revised for payrolls made on or after January 1 2022. You dont need to do anything at this time. Enter your federal income tax withheld to date in 2022 from all sources of income.

51 Agricultural Employers Tax Guide. Toggle navigation BIR Tax Calculator. For help with your withholding you may use the Tax Withholding Estimator.

To keep your same tax withholding amount. Pay FUTA Unemployment Tax. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

The 202223 US Tax Calculator allow you to calculate and estimate your 202223 tax return compare salary packages review salary examples and review tax benefitstax allowances in 202223 based on the 202223 Tax Tables which include the latest Federal income tax rates. To change your tax withholding amount. In order to print a tax withholding election form to submit to ETF click the Print Tax Withholding Election Form button.

Note that this amount is significantly lower than 2021. This calculator can be used to determine how much you would like to withhold from your benefit payment for taxes. 2021 2022 Paycheck and W-4 Check Calculator.

However as per Taxation and Other Laws Ordinance 2020 any delay in payment of tax which is due for payment from 20-03-2020 to 29-06-2020 shall attract interest at the lower rate of 075 for every month or part thereof if same is paid after the due date but on or before 30-06-2020. Fill up the data Press Calculate button below and we will do the BIR TRAIN Withholding Tax Computation for you. This publication contains the wage bracket tables and exact calculation method for New York State withholding.

Looking for a quick snapshot tax illustration and example of how to calculate your. Other Oregon deductions and modifications. To access Withholding Tax Calculator click here.

2022 CWB amounts are based on 2021 amounts indexed for inflation. This publication supplements Pub. For employees withholding is the amount of federal income tax withheld from your paycheck.

Further withholding information from the IRS can be found here. No the calculator assumes you will have the job for the same length of time in 2022. The AZ Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in AZS.

15 Employers Tax Guide and Pub. Now you can easily create a Form W-4 that reflects your planned tax withholding amount. You as the employer will pay 6 of each employees first 7000 of taxable income.

ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. 2022 income tax withholding tables. 2022 Philippines BIR TRAIN Withholding Tax Calculator.

2022 Income Tax Withholding Tables Changes Examples

Calculating Federal Income Tax Withholding Youtube

How To Calculate Federal Income Tax

The Beginner S Guide To Federal Payroll Tax Withholding Entertainment Partners

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

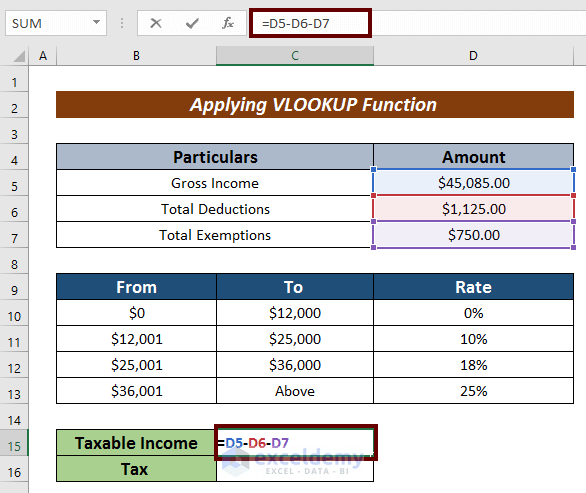

Formula For Calculating Withholding Tax In Excel 4 Effective Variants

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Federal Withholding Tax Youtube

How To Calculate Payroll Taxes Methods Examples More

Paycheck Calculator Take Home Pay Calculator

How To Calculate Federal Income Tax

How To Calculate Federal Income Tax

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

Calculation Of Federal Employment Taxes Payroll Services

Federal Income Tax Fit Payroll Tax Calculation Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download